Sophie Heald, Cambridge Econometrics

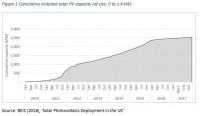

In February 2016, the solar PV tariff rate in the UK was reduced from 12.47 p/kWh to 4.39 p/kWh. Since that date, growth in small-scale residential solar PV in the UK has slowed dramatically (see Figure 1).

In a recent study for the European Commission[1], we develop a new methodology to model prosumers’ investment decisions. We developed baseline projections and a series of scenarios to assess how take-up of residential Solar PV in the UK (and the wider EU) may be affected by future changes in policy and technology.

Our method takes account of the fact that households weigh up a multitude of both financial and non-financial factors when deciding whether to invest in solar PV. In relation to these financial and non-financial drivers of investment, there is considerable heterogeneity among households. We derive distributions for the cost-effectiveness and overall attractiveness of investment among households in the UK and use this to develop projections of take-up of solar PV.

For each year up to 2030, under specific assumptions about CAPEX and OPEX costs, policy support, future electricity prices and consumer preferences, these distributions are used to derive the share of households for which investment is an attractive option, to derive take-up in each year.

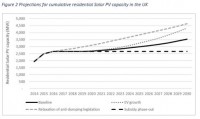

We develop a series of scenarios where different policy and technology assumptions are varied. Our results reflect the balance of two offsetting effects: an improvement in the cost-effectiveness of solar PV investments over time (due to higher electricity prices and lower CAPEX costs) balanced against a smaller pool of potential investors (as those with most favourable preferences towards solar PV, and for which investment is most cost effective, have already installed).

Our results show that:

- In a baseline scenario (where FiT rates are maintained at their current level), there is a huge slump in solar PV investments in the short term until a point is reached in the early 2020s at which electricity prices are sufficiently high (and CAPEX costs sufficiently low) to incentivise new investments

- In a scenario with high penetration of electric vehicles, there is a boost to the financial attractiveness of residential solar PV, as higher rates of self-consumption of electricity can be achieved, and growth in residential solar PV accelerates over the period 2025-2030

- In a scenario where EU anti-dumping legislation is relaxed, the fall in CAPEX costs drives 3-4% pa growth in residential solar PV investment over the period to 2030 (despite the recent cut to FiT rates)

In the short-term, continued roll-out of solar PV faces challenges, as increasing the share of intermittent renewables on the grid could lead to increasingly peaky electricity supply, causing grid congestion and stability issues. Despite these short-term challenges, it is envisaged that, in the medium term, improvements in demand response and roll-out of smart meters, battery and grid storage technologies, as well as increases in electricity demand and synergies with technologies such as electric vehicles, will create opportunities for solar PV capacity to further increase. Our analysis shows that, despite considerable reductions in CAPEX costs over recent years, continued policy support is crucial to achieve further growth in residential solar PV capacity in the UK.

[1] GfK, Cambridge Econometrics et al (2017), ‘Study on Residential Prosumers in the European Energy Union’ Ch. 5. Available online at: https://ec.europa.eu/commission/sites/beta-political/files/study-residential-prosumers-energy-union_en.pdf

Post your comments and questions for the speakers here