Energy Systems Catapult recently published a major report – Rethinking Electricity Markets – which advocates ambitious and far-reaching reforms to electricity markets to make them more innovation-friendly and focused on outcomes for consumers. This blog (published in full on the Catapult website) from George Day, Head of Markets Policy & Regulation at Energy Systems Catapult discusses the challenges and opportunities of ambitious reform.

Energy Systems Catapult recently published a major report – Rethinking Electricity Markets – which advocates ambitious and far-reaching reforms to electricity markets to make them more innovation-friendly and focused on outcomes for consumers. This blog (published in full on the Catapult website) from George Day, Head of Markets Policy & Regulation at Energy Systems Catapult discusses the challenges and opportunities of ambitious reform.

Our most controversial reform proposal is to phase out CfDs – which many see as a huge success story for UK policy over the past decade, and vital for access to low-cost finance for the new generation we need. It is worth stressing we are not advocating the removal of strong incentives for low carbon generation. Rather, we suggest that CfDs should be replaced with a new market-wide decarbonisation policy mandate to drive the investment and innovation needed for a fully decarbonised electricity system.

We agree that CfDs have been crucial over the past decade in helping to drive down the cost of renewables. We also agree that renewables will almost certainly form the backbone of our future electricity system – and therefore that we need lots more investment in them. Any reforms should be implemented to avoid creating any hiatus in investment. In the first instance, this will involve adapting CfDs to minimise distortions to bidding, dispatch, and location decisions before phasing them out. We also agree that it is important to secure good value for consumers in the returns they ultimately pay to investors in electricity assets.

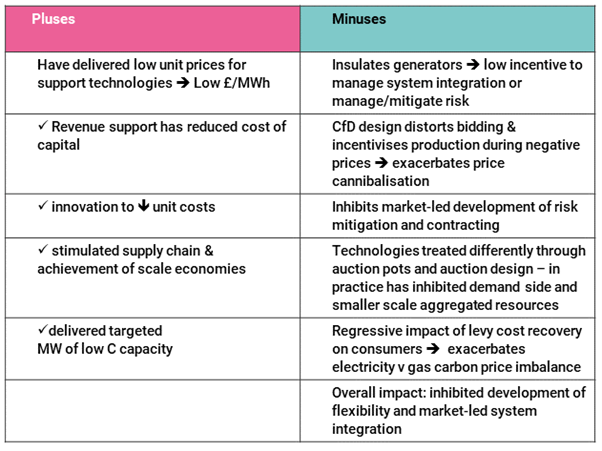

Our argument is that the challenges we now face are different to those faced when CfDs were introduced. We now need to phase in new policy tools that are specifically focused on delivering the transition to a fully decarbonised electricity system. Our Rethinking Electricity Markets paper (see table below) set out how we believe that CfDs increasingly impact the efficient functioning of markets. We believe that there are some significant risks if we stand still and remain reliant on mechanisms like CfDs. Conversely, if we push ahead with ambitious policy reforms that shape efficient markets across the whole electricity system, we can unlock a range of new opportunities and innovation that will save costs and deliver better service outcomes for consumers.

Table: The impacts of CfDs: a rough scorecard

If we fail to continue developing our electricity market and policy framework we risk inhibiting the development of key complementary flexible resources and new forms of contracting and risk mitigation appropriate to a zero carbon electricity system. An exclusive focus on minimising the cost of finance for investors in offshore wind and other CfD supported technologies will risk inhibiting the wider development of the electricity system.

We argue that the market has now matured and the industry is much better placed to manage market and other risks than in 2010. This means we can and indeed should start the process of phasing in a policy framework that is market or system-wide and focused on outcomes for society and consumers. Such a framework can incentivise players across the sector to innovate, invest and integrate in new ways to deliver outcomes for customers, rather than to limit risks for investors in particular categories of projects. Provided this change is implemented carefully, it can deliver stronger and more balanced incentives for investment and innovation throughout the supply chain:

- on project developers of new generation capacity

- on investors in both generation and crucially new forms of flexibility,

- on new trading intermediaries and

- for innovators creating new propositions in the demand side and retail markets.

Retaining investor credibility

There is, however, a strong strain of opinion that argues that the CfD regime remains key for UK to be able to gain continued access to low cost finance for large scale investment in zero carbon electricity resources. The argument – for example as eloquently set out by UKERC Director Professor Rob Gross in a recent blog [1] – is (broadly) that we should not risk the gains that have been achieved in creating a strong and predictable pipeline of projects that can be financed at relatively low cost.

Our contention is that we can shift to an outcome-based policy regime in a way that retains high investor credibility and which works with the grain of the broader UK decarbonisation policy and governance framework, anchored within the statutory carbon budget process and ultimately by the Climate Change Act. Our proposal is certainly not just to abolish CfDs and leave investment to a combination of the current wholesale market and emissions trading.

By phasing in a market-wide decarbonisation mandate, rather than an intervention targeted on and awarded to particular projects, we create incentives to decarbonise that run throughout the system. We move the focus to system outcomes rather than system inputs, creating incentives for investment not only in low carbon generation but also in all forms of flexibility. This will be vital to stimulate and reward investment and innovation that integrates supply from variable and more spatially dispersed renewable resources and matches it with the growing demand from increasingly electrified energy demands for heat, cooling and mobility.

By replacing project-specific support mechanisms with system-wide drivers we also create incentives for market players to harness the power of the technologies key for efficient future system integration and optimisation: digitalisation and innovations in AI, smart control and automation that can unlock flexibility and match zero carbon electrons with energy service demands in real time. By implementing outcome-based policy reforms in the coming years, and by improving the quality of and accuracy of market signals, we also create incentives for market participants to innovate in financing and combining efficient portfolios of electricity resources to deliver a reliable and fully decarbonised electricity system.

Given the sheer amount of investment required to complete the decarbonisation of our electricity system – and to meet growing demand – we need a policy that is robust and credible to investors. We will publish a more detailed dive into the specific considerations relevant to designing a market-wide decarbonisation mandate, but at a high level there are three key design features that we believe will give it investor credibility.

- Investability feature number 1: A market-wide decarbonisation obligation can be framed explicitly around achievement of the desired (indeed legally required) policy outcome of decarbonisation. The key gain from introducing an electricity sector decarbonisation mandate is that it translates the broader Climate Change Act targets into a market mandate that binds on major buyers of electricity, requiring them to progressively reduce the carbon content of their power purchasing. This in turn drives up demand for, and the value of, zero carbon electricity in a way that is predictable and transparent – and which can be built into price expectations and asset valuations. This gives investors confidence in the long term future demand for zero carbon electrons, but also crucially creates a stable demand driver for the innovative assets and trading propositions that match zero carbon generation with demand.

- Investability feature number 2: A new market-wide decarbonisation obligation can reduce policy risk around technology-specific policy design, rule changes and technology-based lobbying. By linking the decarbonisation mandate directly to the legislated carbon budget process, anchoring the policy directly within the Climate Change Act regime and so enhancing policy transparency and predictability for investors. The trajectory placed on a decarbonisation obligation would not be subject to short term or technology specific considerations, reducing policy risk for investors. This would distinguish it from past experience with the renewables obligation which lacked a wider statutory governance framework and became increasingly technology-specific in character, ultimately morphing into a technology-specific innovation/early deployment support mechanism with the introduction of banding rules.

- Investability feature number 3: A market-wide electricity decarbonisation obligation should be reinforced by a range of other sectoral decarbonisation policies that provide guaranteed long-term demand growth for zero carbon electricity and can be transparently reflected in market expectations. A range of sectoral policies have been put in place (e.g. the ban on sale of ICE vehicles and emerging sectoral policy on building decarbonisation) which will progressively drive up demand for zero carbon electricity. These new electrification demands will also open up new possibilities for innovative load management that can mitigate wholesale market and offtake risks for investors in generation assets with particular characteristics.

Many readers will recall that investors pressed hard for the revenue stabilisation provided by CfDs when DECC was designing EMR proposals back in 2010-11, in preference to the RO system that was the main renewables support mechanism at the time. This has led some to argue that policy-mediated revenue stabilisation is a required condition for investor credibility. We think circumstances have moved on considerably since the days of the renewables obligation, and that a market-wide decarbonisation mandate can be designed and framed in way that is transparent, and predictable, and becomes hard-coded into market expectations making it highly investable across a broader range of electricity assets – underpinning investment in flexibility and system integration as well as generation.

Let’s turn now to consider some of the concerns that we have heard in response to our proposals. The two most common responses have centred around:

- Concern that phasing out CfDs would simply drive up the cost of capital for investment in projects that currently benefit from the revenue stabilisation provided by CfDs and, ultimately, result in higher costs for consumers. In particular, it is argued that investors are reluctant to be exposed to market price variability and place a high premium on the revenue stabilisation offered by CfDs.

- Concern that energy suppliers would not be a bankable counterparty for investment in major projects, and that that would result in the UK struggling to attract sufficient investment in zero carbon electricity resource.

What would be the impact of a market-wide decarbonisation mandate on the cost of capital?

So what about the impact of our proposals on the cost of capital for large scale renewables generation projects like offshore wind? Some have asked us whether we have quantified the impact of our proposals on the cost of capital for windfarms – where the government has set a hugely demanding target of 40GW by 2030 – and where many 2050 scenarios envisage more than 80GW capacity by 2050.

It’s quite difficult to argue this case empirically. The truth is we simply don’t yet know what cost of capital would be achievable by offshore wind projects (for example) under an alternative regime that did not rely on CfD style mechanisms to stabilise revenues. It’s also important to be circumspect about our ability to accurately estimate the cost of capital that will, in practice, be demanded by investors.

My experience working as a regulator on successive network price controls tells me how difficult this is. Regulators like Ofgem and Ofwat have regularly commissioned detailed and expensive consultancy studies to guide their judgements on the required cost of capital for network price controls, and then within a few years later been criticised roundly for being over-generous to investors at the expense of customers. The lesson I take from this is that financial markets adapt and often find ways to innovate – in effect to outperform regulatory estimates of the achievable WACC – if there is an incentive (i.e. an extra profit or return for investors) to be made.

Having said that there are some pieces of evidence we can turn to which give us a sense of likely materiality.

- A 2020 paper from Imperial College Business School has argued that CfDs can reduce the WACC at an asset level by up to 2 percentage points [2], and suggests that exposing investors to merchant risk could constrain renewables development and result in higher costs overall. Our proposals are based on a different view of the evidence about the potential risks and benefits of reform – which we set out below.

- A 2018 report for BEIS by Europe Economics [3] provided an empirical update of the cost of capital for different electricity technologies, and interestingly provided a specific estimate of the impact of the revenue support provided by CfDs value of revenue. It estimated that revenue support reduced the Weighted Average Cost of Capital (WACC) by 1.3% for offshore wind projects and 0.8% of onshore wind.

- The Carbon Trust and UCL published an analysis of cost reduction in UK offshore wind [4] in 2020 and concluded that a number of interacting cost drivers ultimately accounted for the astonishing cost reduction in offshore wind during the 2010s in the UK. Their estimate (based on qualitative interviews) was that the reduction in financing costs accounted for around a fifth of the overall cost reduction achieved during that period, with other key factors in cost reduction included economies of scale, public and private R&D and learning by doing effects. The same report also estimated that the WACC offered to developers had reduced from over 10% in 2010 to below 7% by 2020. It is worth noting that the underlying cost of risk free debt (e.g. yields on 10 year UK government bonds) also reduced by around 2% over the same period [5].

Taken together, these pieces of evidence above suggest that the removal of CfDs could result in a noticeable increase in the cost of capital for the categories of projects that currently benefit from them. The Europe Economics and other figures suggest that around 1% on WACC might be a reasonable estimate of the size of this effect – at least in the short run until financial markets adapt and gain experience.

In the longer run we might expect this to reduce over time as financial markets – and the underlying ‘real economy’ of innovation and supply chains – adapt to manage and mitigate the market risks associated with matching supply of zero carbon electrons to the changing shape of demand for them – as swathes of heat and mobility energy demand are electrified in the decades ahead.

Weighing the potential costs and benefits of moving from CfDs to a system-wide decarbonisation mandate

This naturally leads to another set of questions. Would the benefits from replacing CfDs (e.g. improved incentives for investment and innovation in flexibility and system integration) be likely to outweigh the increase in costs resulting from a higher WACC required (whether permanently or temporarily) for some generation investment categories that would be required to bear or manage more market risks under a market-wide decarbonisation mandate?

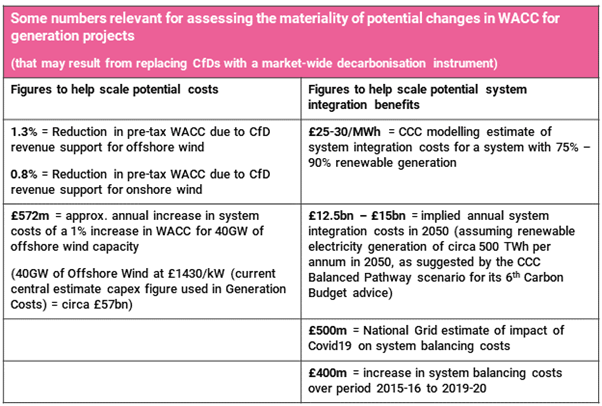

Again, this is a pretty difficult question to answer with confidence, so we must turn to available empirical and modelling evidence as a guide. At a very basic level we can turn to some of the aggregates involved to understand how material a potential increase in the WACC for generation investments might be. The table below pulls together some relevant numbers for a high-level assessment.

As set out above a figure of around 1% on WACC could be taken as a reasonable guide to work with, based on the Europe Economics estimate and supported by other estimates. We then look at the order of magnitude of the capex spend involved – using the 40GW of offshore wind target and the latest BEIS generation cost estimates. A back of envelope calculation suggests that the annual system costs ultimately recovered from electricity consumers would increase by around £570m per annum if we assumed that all 40 GW of capacity had to be financed at a 1% higher WACC.

We can then compare that with some figures that give us a sense of the potential benefits at stake as we decarbonise the electricity system. In their analysis for the 6th Carbon Budget, the CCC suggest that system integration costs could be in the range of £25-£30/MWh for a system with high renewables penetration. The CCC’s Balanced Pathway scenario suggests that generation from renewables could be around 500TWh by 2050 – suggesting that the system integration value at play could be estimated to be up to £15bn per annum. I make no claim for that figure – apart from it being a very rough indication of the order of magnitude of the potential value at stake. In magnitude, it is similar to the figures we can deduce from system cost differences reflected in modelling of alternative future systems commissioned by ESC (quoted in the recent blog by my colleague Sarah Keay-Bright).[10]

Some figures based on recent history also suggest that there is significant value at stake in improving the system integration outcomes from our electricity market and policy framework. System balancing costs have increased progressively over the past decade, rising by £400m over the past 5 years. As the CCC’s work suggests, system balancing pressures and challenges are likely to grow as renewables penetration increases – and we would argue that we risk exacerbating these pressures if we fail to move forwards with ambitious reform of electricity markets.

Recent history also suggests that we should not under-estimate the degree to which supply chains and financial markets can innovate and drive down costs. We argue that this also applies not only to the hard engineering and physical supply chains of turbines and generation kit but also to the more service-based, data-based and softer components of the system and supply chains (financial markets, trading, digitalisation, data management, smart controls, automation, service design and consumer user experience) that will be vital in the next phases of the transition.

In practice, how might financial markets respond to changed policies – and what about counterparty risk?

The arguments about the cost of capital tend to be quite static and asset-specific. This can underplay how financial markets (and their pricing of risk) has a track record of evolving over time, as information emerges and as investors gain experience and confidence – indeed the history of offshore wind finance in the UK suggests as much. Back in 2010 much of the commentary focused on the difficulty of gaining access to lower cost bank financing for offshore wind projects, particularly for their construction phase [11]. A decade later there has been a huge expansion in non-recourse project finance involvement in offshore wind projects.

The review of financing for offshore wind by Ashurst sets out [12] a wide range of ways in which the detailed structuring of offshore wind deals has developed over the past decade to deal with the very specific risks faced by projects. It also talks through a range of strategies for handling market and counterparty/offtaker risk. These strategies will come into play and deal structuring will adapt and develop to manage changes in the risk profile arising from changes to policy support mechanisms. By requiring market players to manage market risks – rather than dispersing it across millions of individually powerless consumers – we are likely to see a step change improvement in market functioning and in the combination of technologies, trading strategies and deal structuring that allows players to manage market risk.

Of course, if government effectively continues to provide revenue risk mitigation for investors then financing structures are unlikely to adapt and develop to manage the inherent risks of matching supply and demand in deeply decarbonised electricity systems. In turn, this will inevitably lead to less focus on technologies, projects and business models that actually do address the physical risks of matching supply and demand (in the form of smart, controllable flexibility and storage of various kinds, efficiently integrated into the electricity system).

In judging what is likely to happen if we replace CfDs, we can also look at the dynamics of what is happening in jurisdictions where renewables projects do not currently benefit from a socialised/regulated revenue stabilisation regime. North American markets are helpful exemplars here. My reading of North American evidence suggests some (perhaps fairly obvious) but nonetheless important observations for considering how UK power finance markets and deal structuring might adapt to the kind of market reforms we proposed in Rethinking Electricity Markets.

- Renewables projects do not appear to be unfinanceable in the absence of revenue stabilisation through policy support. Texas, one of the most market-oriented states has built over 30GW of wind capacity, more broadly many US states have driven renewables through portfolio standards. In Texas, despite the financial fallout from the February blackouts, the finance community is now actively looking at how to improve risk management for merchant wind projects.[13] The US trade press reveals the depth of attention to risk management and deal structuring through what appear to be more active and innovative financial and insurance markets that provide a range of options for hedging, managing and diversifying risks. This also appears to focus investor attention more naturally on some of the potential physical/technical solutions to ‘covariance risks’ for renewable generators, such as batteries.

- There are a range of contracting solutions including a more active corporate PPA market and city and local authority participation in power purchasing. US markets appear to have more active and developed corporate PPA markets than in many European markets. These provide a route to market and help to manage offtake risks for renewables projects [14]. Cities and local authorities are also becoming active in power purchasing – the idea of ‘Community Choice Aggregation’ where cities or counties (in states that have the enabling legislation including California, Massachusetts and New Jersey) buy and/or generate electricity for residents and businesses within their areas provides another route to market for renewables projects. [15]. CCA’s enable communities to aggregate demand, gain market leverage and choose greener sources of power.

- Energy storage investment is bigger and more active in US markets. One recent report suggests that US accounted for 38% of new global energy storage capacity in 2020 [16]. A recent Wood Mackenzie report sees progress in Europe as significantly slower than in US or Asia Pacific regions. A November 2020 article by John Parnell on the Greentechmedia website discusses the Wood Mackenzie view on the weakness of European markets for energy storage investment compared with other markets particularly US and China. The technology-specific approach to renewables support is seen as a key contributory factor.

“The primary route to market for [renewables] is through government auctions. Current renewable auctions offer little or no value for flexibility, hence the lack of credible hybrid project pipeline development compared to global counterparts,” said McCarthy [Wood Mackenzie Principal Analyst]. [17]

One final point on the US market is to observe that the Biden administration’s proposals for a Clean Energy Standard look and sound very similar to the concept of a market-wide decarbonisation mandate. The Biden Clean Energy Standard proposal also targets the goal of decarbonising power by 2035 – a very similar target to the one that the UK must achieve.

Drawing the threads together

So drawing these threads together, we think that now is the time to push ahead with reforms that are capable of stimulating the innovation, supporting the investment, shaping the supply chains, and structuring the financing of a smart, decentralised, digitalised and fully decarbonised electricity system. The job of putting in place a reliable, integrated 600 TWh zero carbon electricity system will require this. A system-wide outcome-based approach to policy is required.

In the short run, yes, this will involve change to the financing arrangements for technologies that currently benefit from CfDs. But the evidence does not suggest that transition costs are likely to be prohibitive and experience strongly suggests that financial markets will adapt. Policy can be constructed to give investors and analysts transparency and predictability, allowing market-led approaches to risk management to develop, while reducing the policy risks that markets find so difficult to manage. And finally, the upside of both the system value at stake and the potential innovation throughout the electricity value chains appears high.

This blog was first published by Energy Systems Catapult on July 29th 2021 . You can read their Rethinking Electricity report and associated reports on their website

Comments for BIEE Members only.

Sign in or become a member today.